Financial well-being March 8, 2018 By

Join the March 2018 Student Loan Debt Movement, today!

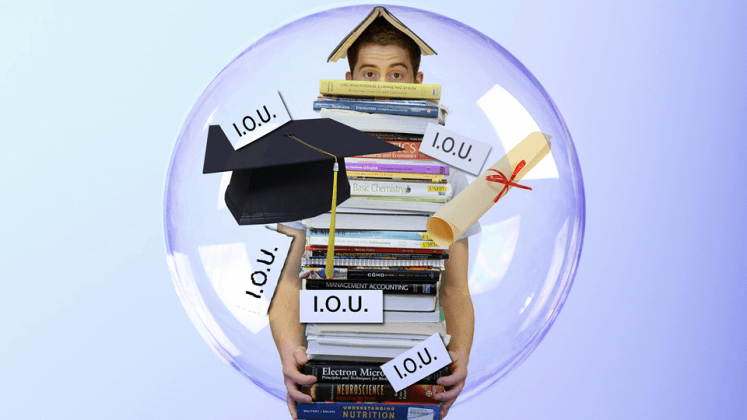

According to the Federal Reserve Bank of New York, outstanding student loan debt stood at $1.38 trillion as of December 31, 2017. If student loan debt is something that you currently struggle with,- you are not alone!

Today, I have an opportunity to share something that can help make a dent in your student loan debt. It’s called THE STUDENT LOAN DEBT MOVEMENT! The goal of the movement is to educate, inspire, and encourage action to pay down student loan debt. Act quickly, because the student loan debt movement is only happening during the month of March.

The Student Loan Debt Movement is a group of financial bloggers, "podcasters," "Instagrammers" and "YouTubers" that have joined together with the goal of paying down, reducing, or eliminating a million dollars in student loan debt during the month of March. The idea was created by Robert Farrington from TheCollegeInvestor.com. Robert has created a webpage to help get the movement started. You can check out the webpage here – The Student Loan Debt Movement.

As an incentive, they’re giving away $500 per week when you join the movement to help you eliminate your student loan debt. Additionally, there is a "Student Loan Debt Elimination Leaderboard" where participants can share how much student loan debt they have eliminated to inspire others, as well as be entered into another cool giveaway opportunity.

So, why did Robert Farrington create the student loan debt movement? He states the following: “Student loan debt drives me nuts. Beyond the financial toll it can take on borrowers, getting out of it can be a hard and confusing process. With so many different payment plans, loan forgiveness options, different loan types, it can be really hard to know the best path to get out of student loan debt. And that doesn't even take into consideration the emotional toll that student loans can have. From depression, to a delay of life events like buying a house or starting a family, student loan debt is a struggle.”

I completely agree with Robert’s comment, so I had to share this information and this challenge with our Spend Life Wisely community.

Maybe you’re lucky and do not owe money on student loan debt, but it's possible that your child(ren) or a family member may have plans to get a degree in the future. Check out this article, “5 Ways to Make College More Affordable,” for additional ways help you stay out of the student loan debt crunch.